Facts About Palau Chamber Of Commerce Uncovered

Wiki Article

The smart Trick of Palau Chamber Of Commerce That Nobody is Discussing

Table of Contents3 Easy Facts About Palau Chamber Of Commerce DescribedGet This Report on Palau Chamber Of CommercePalau Chamber Of Commerce for BeginnersWhat Does Palau Chamber Of Commerce Mean?3 Easy Facts About Palau Chamber Of Commerce ShownNot known Factual Statements About Palau Chamber Of Commerce The Definitive Guide to Palau Chamber Of CommerceIndicators on Palau Chamber Of Commerce You Need To Know

The Single Strategy To Use For Palau Chamber Of Commerce

donation sizeContribution when the donation was contribution, who donatedThat contributed much, a lot they exactly how to your website, site) Finally, donation pages contribution web pages convenient and practical for your donors to give!Be certain to collect e-mail addresses and various other relevant data in a correct method from the start. 5 Take care of your individuals If you haven't dealt with working with as well as onboarding yet, no fears; now is the time.

There are several donation software program out there, and also not using one can make on the internet fundraising fairly inefficient or even impossible. It is essential to pick one that is easy for you to establish and handle, is within your spending plan, as well as offers a smooth contribution experience to your benefactors. Donorbox is the most budget friendly contribution system out there, billing a tiny system fee of 1.

The Palau Chamber Of Commerce Diaries

To get more information, take a look at our write-up that speaks more in-depth regarding the major nonprofit funding sources. 9. 7 Crowdfunding Crowdfunding has actually come to be one of the essential methods to fundraise in 2021. Therefore, nonprofit crowdfunding is getting the eyeballs these days. It can be utilized for certain programs within the company or a basic contribution to the reason.

Throughout this action, you might intend to think of turning points that will suggest a possibility to scale your not-for-profit. As soon as you have actually run for a little bit, it is very important to take a while to think of concrete growth goals. If you haven't already created them throughout your preparation, develop a collection of crucial efficiency signs as well as milestones for your nonprofit.

Palau Chamber Of Commerce Fundamentals Explained

Resources on Starting a Nonprofit in different states in the United States: Starting a Nonprofit Frequently Asked Questions 1. How much does it set you back to begin a nonprofit company?How much time does it take to establish up a not-for-profit? Depending upon the state that you remain in, having Articles of Incorporation approved by the state federal government might take up to a few weeks. When that's done, you'll need to request acknowledgment of its 501(c)( 3) condition by the Internal Earnings Solution.

Although with the 1023-EZ kind, the handling time is usually 2-3 weeks. 4. Can you be an LLC as well as a not-for-profit? LLC can exist as a nonprofit restricted obligation firm, nonetheless, it should be entirely owned by a single tax-exempt nonprofit organization. Thee LLC ought to also meet the requirements according to the IRS required for Restricted Responsibility Firms as Exempt Company Update - Palau Chamber of Commerce.

Not known Facts About Palau Chamber Of Commerce

What is the difference in between a structure and a not-for-profit? Foundations are usually funded by a household or a business entity, yet nonprofits are moneyed through their earnings as well as fundraising. Foundations normally take the money they started with, invest it, and after that disperse the money made from those financial investments.Whereas, the money a not-for-profit makes are used as running costs to money the company's objective. However, this isn't always true when it comes to a foundation. 6. Is it tough to start a nonprofit organization? A nonprofit is an organization, but beginning it can be rather extreme, calling for time, clarity, and money.

There are a number of actions to begin a nonprofit, the barriers to entrance are reasonably couple of. 7. Do nonprofits pay taxes? Nonprofits are exempt from federal earnings tax obligations under area 501(C) of the IRS. Nevertheless, there are particular situations where they might require to pay. If your not-for-profit makes any kind of earnings from unconnected tasks, have a peek at this website it will certainly owe revenue taxes on that amount.

Little Known Questions About Palau Chamber Of Commerce.

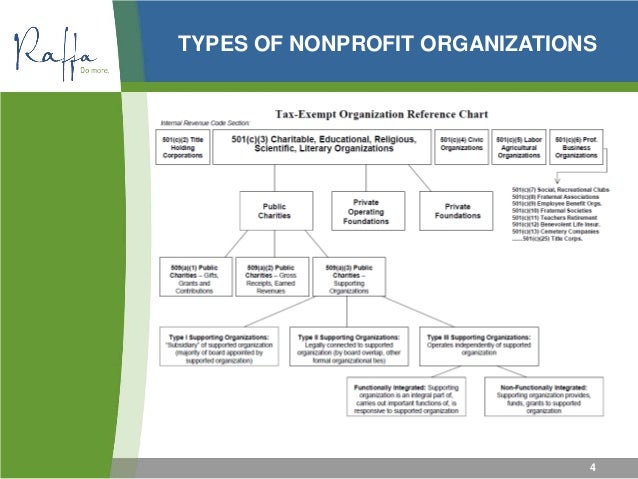

The duty of a nonprofit organization has actually always been to develop social change and also lead the way to a far better world., we focus on services that aid our nonprofits boost their contributions.By far the most typical kind of nonprofits are Section 501(c)( 3) organizations; (Area 501(c)( 3) is the component of the tax code that licenses such nonprofits). These are nonprofits whose mission is charitable, religious, educational, or scientific.

This classification is very important because personal structures undergo strict operating policies and also regulations that do not relate to public charities. For instance, deductibility of payments to a personal foundation is more limited than for a public charity, as well as private foundations are subject to excise taxes that are Your Domain Name not troubled public charities.

The Greatest Guide To Palau Chamber Of Commerce

The lower line is that exclusive foundations obtain much even worse tax treatment than public charities. The primary difference between exclusive structures as well as public charities is where they get their financial backing. An exclusive foundation is commonly managed by a private, family, or corporation, and also acquires a lot of its revenue from a few donors and also financial investments-- a fine example is the Expense and Melinda Gates Structure.This is why the tax obligation law is so challenging on them. A lot of foundations simply provide money to various other nonprofits. However, somecalled "running foundations"run their own programs. As a sensible issue, you need at the very least $1 million to start an exclusive foundation; or else, it's unworthy the difficulty and also expense. It's not unusual, after that, that a personal structure has been referred to as a large body of money surrounded by individuals who want several of it.

Other nonprofits are not so lucky. The internal revenue service initially presumes that they are exclusive structures. Palau Chamber of Commerce. A new 501(c)( 3) company will be categorized as a public charity (not an exclusive structure) when it applies for tax-exempt standing if it can reveal that it fairly can be expected to be publicly sustained.

The smart Trick of Palau Chamber Of Commerce That Nobody is Discussing

If the internal revenue service identifies the nonprofit as a public charity, it keeps this condition for its very first five years, regardless of the general public assistance it in fact obtains throughout this time around. Beginning with the nonprofit's 6th tax obligation year, it needs to show that it meets the general public support examination, which is based upon the support it receives during the current year as well as previous four years.

Report this wiki page